Bad credit mortgages

Bad credit score? Don’t let that stop you getting a mortgage for your dream home. Mortgage Light can help, based in Milton Keynes.

Get in touch

If you have a quick question, fill-in this form:

Looking to discuss a mortgage?

If you would like to discuss your mortgage requirements with an advisor, please click here to provide more details and speed-up the process.

BAD CREDIT MORTGAGES AVAILABLE.

Bad credit mortgage advisers & brokers in Milton Keynes and across the UK

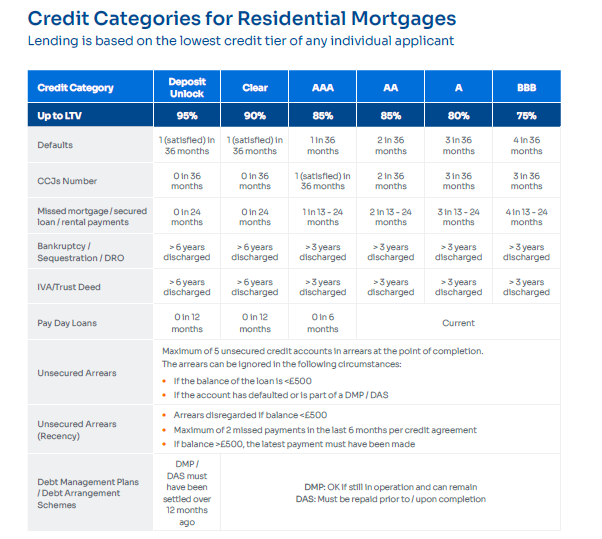

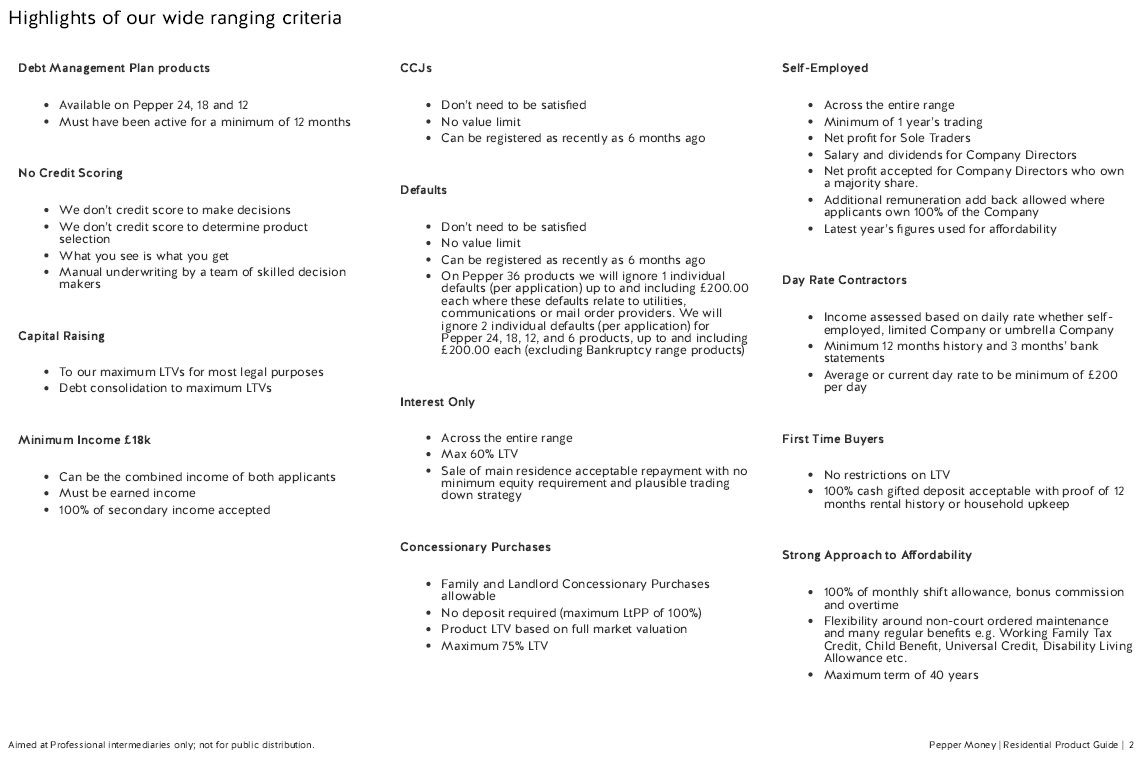

Having a less-than-perfect credit history does not mean you can’t get a mortgage to buy your dream home. If you or your partner have had arrears, defaults, County Court Judgements (CCJs), Debt Management Plans or have been made bankrupt in the past 6 years, there are still mortgage options available - even if a lender has turned you away in the past, it still may be possible for you to obtain an ‘adverse credit mortgage’ or ‘bad credit mortgage’.

The good news is that the UK mortgage market is vast and there are deals out there for all kinds of borrowers. Here at Mortgage Light we are able to research the whole of the market to find the deal that is right for you and this can even be done without the need for a hard credit search - so relax...we are here to help as your bad credit mortgage advisers!

What are bad credit mortgages?

Bad credit mortgages follow the same principle as any other mortgage, however they are designed specifically to help people with a history of poor credit get on the property ladder – this includes those who are employed and self-employed and with both high and low incomes.

With these types of mortgages, it usually means that you may have to pay a slightly higher interest rate than you would get with some of the other high street lenders, as the lenders who specialise in these mortgages will deem you to be a higher risk.

Lenders that deal with bad credit are a short term fix to help you set back into the high street lending space.

Bad credit? Check if you fit these lender options...

Lender 1

Lender 2

BAD CREDIT MORTGAGES AVAILABLE.

The good news...

If you keep up repayments on a poor credit mortgage, your credit rating should improve, and this could enable you to move to a standard mortgage at a lower rate after a few years. By talking to us we can help guide you through the process step by step, and advise of the best course of action to get you on the property ladder.

You may obtain a credit file using a service such as Check My File, which offers a 30-day free trial using our provided link.*

Want to know more about what your credit file means? Check out our

TikTok where we break it down.

*With regards to your full credit report, you can obtain this by clicking here. For your convenience, this will show you an insight into your credit score across 3 of the main credit reference agencies (Equifax, Experian, and Transunion). You can try checkmyfile FREE for 30 days, and cancel at any time. If you do not cancel at the end of the trial, you will then begin to be charged. All details and terms & conditions are on their website. Mortgage Light will receive remuneration from checkmyfile for the introduction.

💡 Working with the leading lenders in the whole of market...

GOT A QUERY...?

Frequently asked questions

Got a question? It might be answered here. You can also head over to our FAQ page to read more of our frequently asked questions.

How do I apply for a bad credit mortgage?

Applying for a bad credit mortgage is very similar to applying for a standard mortgage. The key difference is that lenders will want more detail about your financial history. The steps usually include:

Checking your credit report and addressing any errors.

- Speaking with a mortgage broker who works with lenders open to applicants with bad credit.

- Gathering documents such as payslips, bank statements, and proof of identity.

- Submitting an application to a lender who matches your situation.

- A broker can guide you through the process and improve your chances of finding a competitive deal.

- Speaking with a mortgage broker who works with lenders open to applicants with bad credit.

What are my chances of getting a mortgage with bad credit?

Your chances depend on the type and severity of your credit issues. Missed payments from a few years ago are often seen more favourably than recent defaults or bankruptcies. Lenders will also consider:

- Your income and employment history.

- The size of your deposit.

- The overall stability of your finances.

- With the right lender and advice, many people with poor credit are still able to secure a mortgage.

- Your income and employment history.

I have missed mobile phone payments, does this mean I can only get a bad credit mortgage?

Not necessarily! A missed mobile phone payment will usually show on your credit file, but on its own it may not prevent you from accessing standard mortgage products. If you have other stronger areas of credit history - such as timely payments on loans or credit cards. Some lenders may still consider you for a mainstream mortgage.

Can I get a bad credit mortgage with a 5% deposit?

With only 5%, your options will be limited, but there are lenders who might consider your application depending on the type of credit issues you’ve had and when they occurred. Speaking with a broker can help you find out if this is realistic for your situation.

For the answer to these and many more contact us today! Let us take your worries away as your bad credit mortgage advisers.

SEE WHAT OUR CLIENTS HAVE TO SAY...

Testimonials

HOMEOWNERSHIP FOR EVERYONE.

10 ways first time buyers are getting on the property ladder

As a first-time buyer, there are a number of mortgage products designed to help make homeownership more accessible - particularly if you’re struggling to build up a large deposit.

Low deposit mortgages

Where some lenders will accept deposits as low as 5%, depending on your credit profile and income.

Higher income multiples

Available to applicants with strong rental histories, a high salary, or professional qualifications, often more accessible when you have a larger deposit

Cashback mortgages

A fixed sum back upon completion to help with initial costs - normally linked to new build homes.

Shared ownership

Where you buy a share of a property and pay rent on the remainder – with the option to purchase more shares over time.

Builder or developer incentives

Often offered on new-builds to reduce your upfront costs - there are often ways to work directly with the developer to tailor the deal and explore additional mortgage options.

Joint borrower, sole proprietor mortgages

Sometimes called “income booster” - allowing a parent or family member to support your income without being named on the property

Zero deposit (100%) mortgages

Available in specific circumstances – such as where you've been renting for a period of time and can show a consistent payment record. These are subject to stricter eligibility criteria and affordability checks.

Looking to get more information on your first mortgage?

CONTACT US TODAY

Straight talking mortgage advice.

We make this easy for you. Simply contact us to arrange to come in and discuss your needs. If you’re pushed for time, call one of our expert advisers and we will be able to go through your options in a quick chat over the phone.